How to Protect Your E-commerce Business from Data Breaches and Fraud

Online stores have become a prime target for cybercriminals. The sheer volume of daily transactions makes it nearly impossible for business owners to scrutinize every detail, creating countless opportunities for fraud to slip through.

Fraudsters also benefit from the diversity of payment methods available online. Combine that with the anonymity of the internet and the physical distance separating the buyer from the seller, and you have the perfect recipe for a growing number of data breaches and scams.

Global eCommerce fraud continues to rise at an alarming pace. According to Mastercard, worldwide losses from online fraud reached $41 billion in 2022 and jumped to $48 billion in 2023.

North America currently accounts for over 42% of the total fraudulent transaction value, making it the most targeted region. Europe isn’t far behind, countries like Germany and France are seeing notable increases in fraudulent activities. Meanwhile, in Latin America, about 20% of eCommerce revenue is lost to fraud, with nearly 3.7% of orders classified as illegal. These figures make it clear: the battle against online fraud demands advanced, intelligent systems powered by AI, machine learning, and behavioral analytics.

Mastercard’s data also highlights emerging fraud trends reshaping the eCommerce landscape:

- Promo abuse – exploiting promotional offers such as discount codes, loyalty points, and referral bonuses.

- Friendly fraud (chargeback fraud) – when customers falsely dispute legitimate transactions.

- Account takeover (ATO) – unauthorized access to a user’s account to commit fraud.

- Triangulation fraud – setting up fake marketplaces to steal payment data from unsuspecting shoppers.

- AI-powered crime – fraudsters using artificial intelligence to create more complex and undetectable scams.

Ignoring AI’s role in preventing these threats is a costly mistake. Modern AI systems can detect multiple types of eCommerce fraud, including:

- Credit card fraud: Unauthorized purchases using stolen card details.

- Fake account creation: Using real identities to open fraudulent accounts and make illegal transactions.

- Account takeover: Gaining access to legitimate user accounts to make purchases or steal sensitive information.

- Credential stuffing: Using leaked usernames and passwords to infiltrate accounts across different platforms.

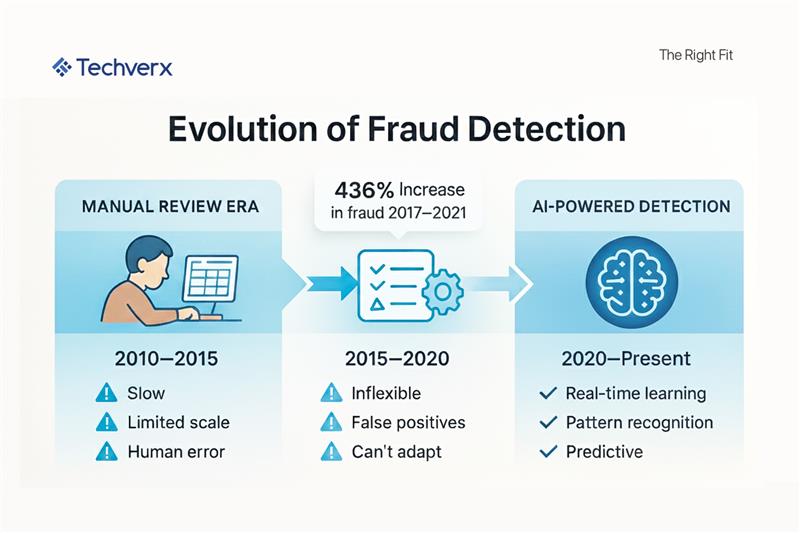

The Evolution of Fraud Detection: From Manual to AI-Powered Techniques

Fraud detection didn’t begin as the sophisticated, automated process we see today. In its early days, it was a manual, tedious task. Teams would gather around spreadsheets, meticulously examining transaction records line by line in search of suspicious patterns. This approach was:

- Extremely time-consuming

- Labor-intensive

- Vulnerable to human error

- More reactive than proactive

Such a process made it nearly impossible to keep pace with fraudsters who were constantly innovating. As online shopping began to expand rapidly, it became evident that traditional manual methods couldn’t keep up. Businesses needed smarter, faster, and more dynamic systems.

With advances in technology came the first wave of automated tools. Platforms like Salesforce CRM Analytics transformed the process from manual record-checking to intelligent, data-driven analysis. This evolution paved the way for rule-based systems, which flagged transactions based on predefined criteria — for example, unusually high transaction amounts or purchases from certain locations. At the time, these systems marked a major leap forward from purely manual review.

However, rule-based detection soon showed its limitations. It lacked the flexibility and intuition needed to adapt to new fraud tactics. Criminals quickly learned how to stay just below the radar of those static rules.

This gap led to the rise of artificial intelligence in fraud prevention. AI revolutionized the field by enabling businesses to process vast amounts of transaction data in real time. Instead of relying on rigid rules, AI-powered systems use intricate algorithms that learn from behavior patterns, cross-reference multiple data points, and detect even subtle irregularities.

Today, AI continuously evolves it, learns from every new data input, adapts to emerging fraud methods, and predicts which activities might signal future risks. It’s no longer just a tool; it’s an evolving, self-improving system designed to stay ahead of the threats.

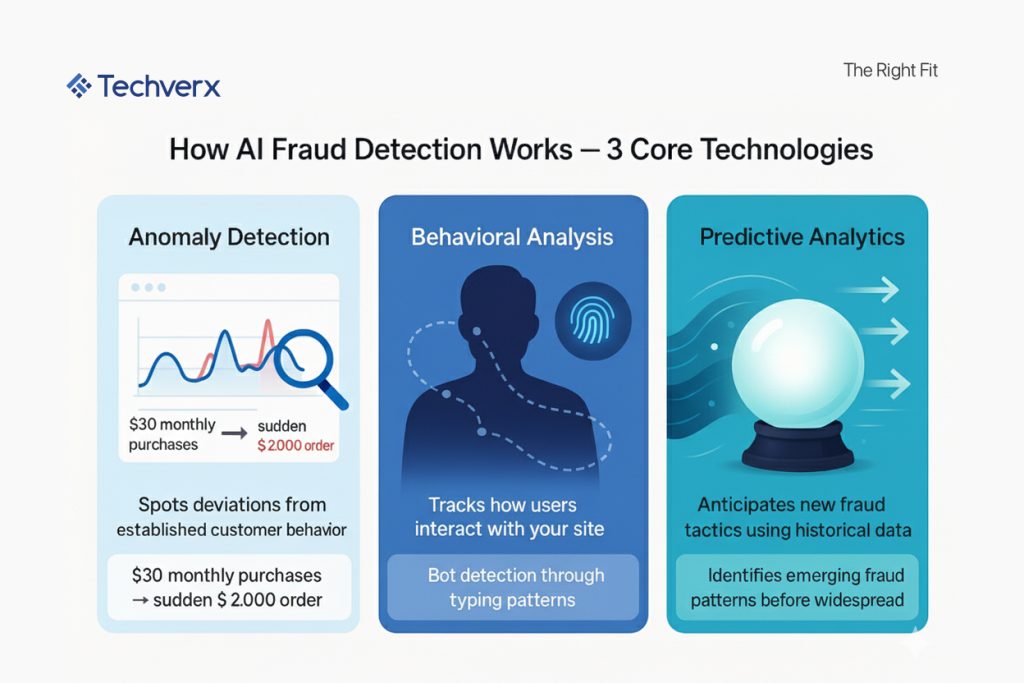

How AI-Driven Fraud Detection Works

AI-powered fraud detection harnesses the capabilities of machine learning to analyze massive volumes of transactions, spot unusual behavior, and detect anomalies, all with minimal human oversight. This autonomy makes the entire process faster, more reliable, and far more effective than manual monitoring.

Take anomaly detection, for instance. AI models are trained to recognize patterns that differ significantly from what’s considered normal. Imagine a customer who usually makes small, occasional purchases. If that same user suddenly attempts a high-value transaction, the AI system flags it as suspicious. Beyond just the transaction amount, the system also considers details such as the customer’s purchase history, IP location, and device information before deciding whether to allow or block the action.

AI’s strength lies in its ability to learn and anticipate. Through predictive analytics, these systems study historical fraud data to forecast emerging schemes before they become widespread. This proactive approach allows eCommerce platforms to adjust their defenses before threats fully materialize.

Another crucial capability of AI lies in its integration with digital forensics tools. Together, they form a powerful combination that not only prevents fraud but also traces its origins. By analyzing digital footprints, AI helps uncover evidence, identify sources of attacks, and enable faster responses to breaches.

All these techniques, anomaly detection, predictive modeling, and forensic analysis, work together to form a multi-layered security shield. The outcome is seamless shopping for legitimate buyers and instant blocking of malicious actors before they can inflict any harm.

Advanced AI Techniques in Fraud Detection

The core of AI-powered fraud prevention lies in methods like anomaly detection, behavioral analysis, and predictive modeling. Yet, as technology advances, even more powerful tools have emerged—most notably deep learning and neural networks—which push the boundaries of what fraud detection systems can understand and predict.

Deep learning employs multi-layered neural networks—hence the term “deep”—to process and interpret complex data patterns. Inspired by the structure and functioning of the human brain, it enables systems to recognize subtle irregularities and hidden connections that simpler algorithms would overlook. This makes deep learning exceptionally adept at identifying sophisticated or emerging fraudulent behaviors that defy conventional rules.

Neural networks, composed of interconnected nodes that simulate human neurons, excel at detecting relationships across enormous datasets. In the context of fraud detection, they can simultaneously assess thousands of transaction attributes—such as purchase timing, frequency, geolocation, and device data—to determine the likelihood of fraud. This parallel processing allows them to distinguish between genuine and deceptive transactions with a level of precision that traditional systems can’t match.

In eCommerce, where every transaction involves intricate, multidimensional data, these advanced AI models shine. They continuously learn from both legitimate and fraudulent patterns, becoming smarter and more accurate with each interaction. The result is an adaptive defense mechanism capable of keeping pace with evolving threats—always refining, always improving.

AI Fraud Detection Examples

Rakuten France

Rakuten France, one of the country’s largest eCommerce platforms, found itself under constant siege from sophisticated bots. These automated programs posed a serious threat, overwhelming systems and demanding constant attention from Rakuten’s technical teams. After enduring ongoing attacks, the company decided to implement AI-driven security measures—a turning point that transformed its operations.

With artificial intelligence now integrated into its fraud detection framework, Rakuten’s system began identifying and blocking malicious activities in real time. This advancement freed its technical teams to refocus on innovation and product improvement, while AI silently handled the heavy lifting of cybersecurity.

BlaBlaCar

For BlaBlaCar, the world’s largest carpooling community, data protection was non-negotiable. The platform hosts millions of user profiles and sensitive personal details, making it a potential goldmine for scammers. The challenge was to secure this extensive database without sacrificing usability or slowing down the app experience.

To achieve this, BlaBlaCar partnered with an agency that introduced an AI-based solution capable of verifying and monitoring activities without requiring direct access to personal information. The outcome was seamless and maintenance-free, users continued to enjoy smooth functionality while their accounts stayed protected from unauthorized access.

Real-World Benefits of AI in eCommerce Fraud Prevention

So, what does adopting AI-based fraud detection actually mean for an eCommerce business? The answer goes far beyond just security. While stronger protection is the most obvious benefit, the ripple effect extends into every part of the customer experience and overall business performance.

Security builds trust, and trust directly impacts sales. When customers feel confident that their data is safe, they’re more likely to complete purchases and return for future ones. Beyond that, AI offers several concrete advantages that make fraud prevention smoother and smarter.

Enhancing the user experience:

AI-powered systems reduce unnecessary friction during checkout. Instead of triggering redundant verifications or lengthy approvals, legitimate transactions are processed quickly and seamlessly. This efficiency leads to higher customer satisfaction and fewer abandoned carts.

Real-time detection and adaptation:

AI doesn’t wait for fraud to happenit , identifies threats as they occur. With continuous learning and real-time analysis, AI instantly reacts to new patterns, minimizing losses that would otherwise accumulate before human intervention.

Reducing false positives:

Traditional systems often misclassify legitimate transactions as fraudulent, frustrating honest customers. AI dramatically reduces these “false alarms” by analyzing multiple contextual factors before making a decision, ensuring that good customers aren’t mistakenly blocked.

Harnessing big data for smarter security:

AI thrives on large and complex datasets. It uses this information to detect hidden correlations, refine its algorithms, and optimize security strategies. The more data it processes, the more intelligent and accurate the protection becomes.

In short, AI-driven fraud detection not only strengthens your defense but also enhances customer trust, operational efficiency, and the overall shopping experience, helping your business grow safely and sustainably.

Secure Your E-commerce Future with AI

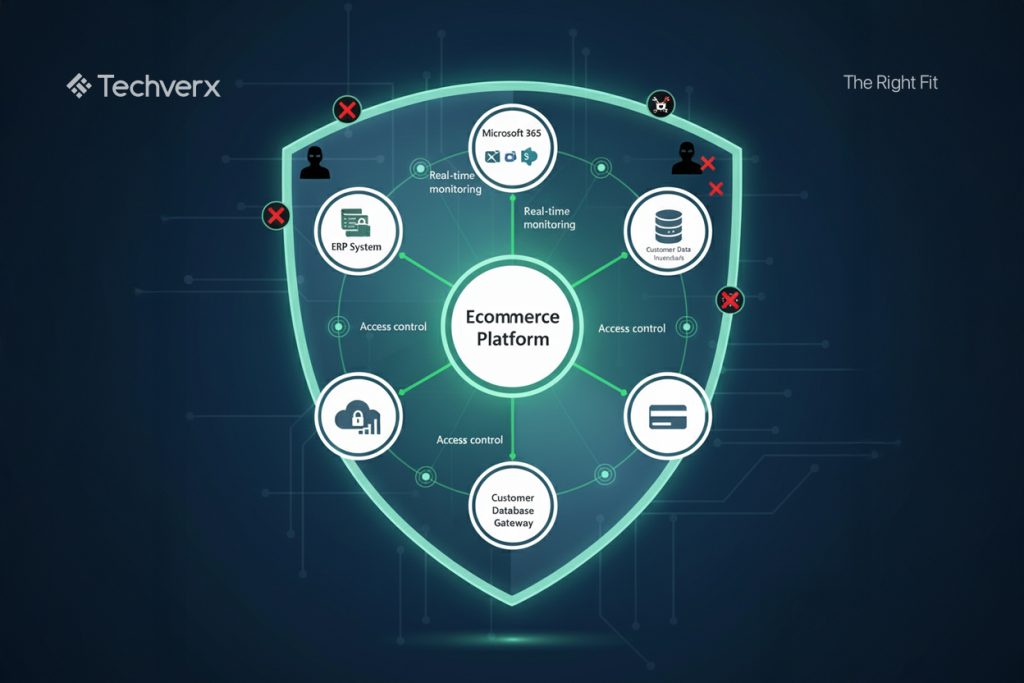

Implementing AI Fraud Detection in eCommerce Platforms

Integrating AI-based fraud detection into your eCommerce ecosystem may seem complex, but breaking the process into clear stages makes it manageable. From defining your requirements to fine-tuning performance, each step helps ensure the system enhances both security and customer experience.

Step 1: Assessing the Needs and Scope

Start by evaluating your existing setup and understanding how your current systems interact with one another. Work closely with your IT team or your technology partner to determine how AI can fit into your workflow without interrupting operations.

Look at your transaction history to identify patterns—are there chargebacks clustering around certain products, price points, or regions? Assess transaction volume and complexity as well. A small online store might do fine with a simple, cost-effective AI tool, while a large-scale retailer handling global transactions may need a more robust and adaptive system.

Keep in mind that an overly aggressive detection system can frustrate customers by flagging legitimate transactions. Balance is key—security must not come at the expense of user experience.

Step 2: Choosing the Right AI Solution

Once you’ve mapped out your needs, the next step is selecting the right AI tool. Look for features such as:

- Real-time transaction monitoring

- Behavioral analytics

- Predictive risk assessment

- Scalability

- Integration compatibility with your CMS, payment gateways, and CRM

Also, consider your cloud security framework to ensure the chosen AI system complements—not compromises—your other security layers.

One potential pitfall is overcomplicating the checkout process. Too many verification steps, such as repeated CAPTCHA prompts or lengthy identity checks, can lead to cart abandonment. To avoid this, test your AI solution in a sandbox environment first. Run it on a small set of transactions to assess its detection accuracy, ease of integration, and overall impact on customer flow before a full-scale rollout.

Step 3: Integration

Once you’ve finalized your AI tool, the next phase is technical integration. This involves configuring API connections, aligning endpoint settings, and establishing secure data encryption and transmission protocols.

Be meticulous when defining the system’s parameters. Your AI model should effectively detect suspicious activity while allowing legitimate transactions to go through unhindered. Fine-tune its rules based on your customer base, transaction types, and typical risk exposure.

After setup, test how the AI interacts with every component of your platform, especially payment gateways and databases. Verify that customer data is handled ethically and securely, in full compliance with privacy laws like GDPR and CCPA.

Step 4: AI-Based Identity Verification

Adding AI-powered identity verification provides another powerful layer of protection. Features like facial recognition, voice authentication, and pattern analysis can confirm that a buyer truly matches their credentials.

For example, AI can compare a customer’s selfie with their government ID, analyze speech to confirm human presence, or cross-check purchasing patterns against their history. These steps significantly reduce risks like identity theft and account takeovers.

Step 5: Training and Continuous Learning

Even the best AI tools need informed people behind them. Training your team ensures they know how to configure, monitor, and act on AI insights. Consider using mentoring software to help employees develop the technical understanding needed to troubleshoot or adjust the system when required.

Host training sessions, webinars, or internal workshops to demonstrate the tool’s features and teach teams how to interpret alerts. Use real-life case studies—like when the system successfully stopped a fraudulent attempt—to make learning practical and relevant.

Since AI constantly evolves, your training materials should too. Keep them updated, and create open communication channels for your team to share feedback. Track metrics like fraud detection accuracy, number of flagged transactions, false-positive rates, and system response times to gauge performance over time.

Step 6: Enhancing Customer Service

AI doesn’t just protect, it also improves the shopping experience. For instance, it can analyze behavior to personalize recommendations or use AI chatbots to handle inquiries instantly.

When an issue arises, such as a delayed shipment, AI can automatically send personalized notifications explaining the situation and offering a resolution timeframe. This proactive approach reduces customer frustration and support workload.

Still, human touch remains vital. For sensitive or complex issues, customer service representatives should step in. Blend automation with empathy to maintain trust and connection.

Collecting customer feedback about their experiences with chatbots or fraud alerts can also help refine your AI systems. Use these insights to adjust and optimize your processes further.

The Future of AI in Fraud Detection

The year 2023 made one thing unmistakably clear: the future of fraud detection belongs to AI. Companies across industries are pouring resources into building smarter, faster, and more autonomous systems. The question “Can AI detect fraud?” has evolved into a statement of fact, AI doesn’t just detect fraud; it predicts and prevents it.

Looking ahead, AI’s role will only grow more sophisticated. Future models are expected to incorporate advanced predictive intelligence, capable of analyzing not just transactional data but also broader factors such as economic shifts and regional fraud trends. For instance, AI could foresee that a fraud technique gaining traction in one part of the world might soon emerge elsewhere—and prepare countermeasures in advance.

As deep learning continues to mature, AI systems will handle even more nuanced decisions with minimal human guidance. These improvements will allow fraud detection tools to interpret complex behavioral signals and make accurate judgments in real time, without constant recalibration.

However, with this technological leap comes responsibility. AI systems learn from enormous datasets, which raises critical questions about data privacy and ethical usage. Businesses must ensure that AI models are trained and maintained responsibly, preserving the very privacy they were designed to protect.

Another challenge lies in algorithmic bias. If an AI system is trained on skewed or incomplete data, it could make unfair or inaccurate fraud assessments. To prevent this, companies should prioritize clean, unbiased datasets and regularly audit their models to eliminate bias.

Over-reliance on AI poses its own risks as well. While automation increases efficiency, human oversight remains essential. Experts should routinely review AI decisions, validate results, and ensure fairness. Periodic audits, updates, and ethical reviews will help keep these systems balanced—powerful yet accountable.

In short, the future of AI in fraud detection will be defined by innovation paired with integrity. Businesses that embrace both will not only outsmart fraudsters but also earn lasting trust from their customers.

Secure the Future, Embrace AI for Fraud Protection

Cyber threats are growing more complex, more intelligent, and more unpredictable every day. Traditional defense mechanisms, like static web application firewalls (WAFs) or basic CAPTCHA systems—simply aren’t enough anymore. Combine that with the massive number of daily eCommerce transactions and the lightning-fast speed at which they occur, and the challenge becomes clear: you need protection that can think, adapt, and evolve.

That’s where AI changes everything. When combined with machine learning and advanced analytics, AI empowers online retailers to detect suspicious activity in real time, predict new forms of fraud before they surface, and keep customer trust intact.

But implementing AI securely is not just about deploying algorithms, it’s about designing a complete ecosystem that integrates intelligence, compliance, and scalability. And this is exactly where Techverx comes in.

At Techverx, we help eCommerce businesses build secure, AI-powered fraud detection systems that evolve as fast as threats do. Our experts design solutions that:

- Learn continuously: adapting to new fraud tactics and patterns in real time.

- Minimize false positives: ensuring smooth, interruption-free transactions for genuine customers.

- Comply with data protection standards: following strict GDPR, CCPA, and PCI-DSS requirements.

- Integrate seamlessly: with your existing CMS, payment gateways, and analytics tools.

- Scale effortlessly: growing with your business as your transaction volume and complexity increase.

We combine AI, machine learning, and cloud security best practices to create defenses that don’t just protect your business but also strengthen customer confidence. With Techverx, you gain a long-term technology partner who ensures your fraud prevention system stays accurate, adaptive, and future-ready.

In today’s world, security isn’t a checkbox, it’s a continuous commitment. By investing in AI-driven fraud detection with Techverx, you’re not just protecting your platform; you’re safeguarding your brand, your customers, and your future.

Hannah Bryant

Hannah Bryant is the Strategic Partnerships Manager at Techverx, where she leads initiatives that strengthen relationships with global clients and partners. With over a decade of experience in SaaS and B2B marketing, she drives integrated go-to-market strategies that enhance brand visibility, foster collaboration, and accelerate business growth.

Hiring engineers?

Reduce hiring costs by up to 70% and shorten your recruitment cycle from 40–50 days with Techverx’s team augmentation services.

Related blogs